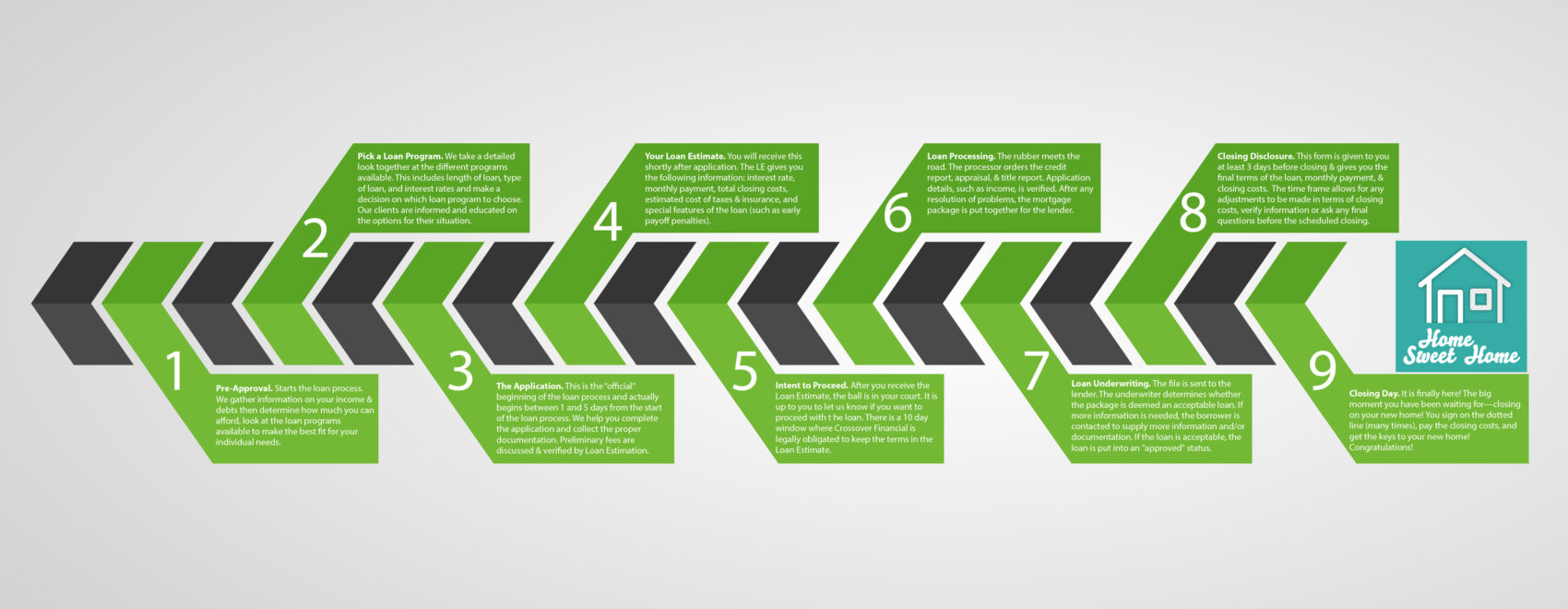

We are here to walk you through the process of applying for a mortgage—every step of the way. Our goal is to create a positive experience from application through closing. Generally, these are the steps we follow to have you attain your dreams and plans of home ownership.

- Pre-Approval. Starts the loan process. We gather information on your income & debts then determine how much you can afford, look at the loan programs available to make the best fit for your individual needs.

- Pick a Loan Program. We take a detailed look together at the different programs available. This includes length of loan, type of loan, and interest rates and make a decision on which loan program to choose. Our clients are informed and educated on the options for their situation.

- The Application. This is the “official” beginning of the loan process and actually begins between 1 and 5 days from the start of the loan process. We help you complete the application and collect the proper documentation. Preliminary fees are discussed & verified by Loan Estimation.

- Your Loan Estimate. You will receive this shortly after application. The LE gives you the following information: interest rate, monthly payment, total closing costs, estimated cost of taxes & insurance, and special features of the loan (such as early payoff penalties).

- Intent to Proceed. After you receive the Loan Estimate, the ball is in your court. It is up to you to let us know if you want to proceed with t he loan. There is a 10 day window where Crossover Financial is legally obligated to keep the terms in the Loan Estimate.

- Loan Processing. The rubber meets the road. The processor orders the credit report, appraisal, & title report. Application details, such as income, is verified. After any resolution of problems, the mortgage package is put together for the lender.

- Loan Underwriting. The file is sent to the lender. The underwriter determines whether the package is deemed an acceptable loan. If more information is needed, the borrower is contacted to supply more information and/or documentation. If the loan is acceptable, the loan is put into an “approved” status..

- Closing Disclosure. This form is given to you at least 3 days before closing & gives you the final terms of the loan, monthly payment, & closing costs. The time frame allows for any adjustments to be made in terms of closing costs, verifies information or asks any final questions before the scheduled closing.

- Closing Day. It is finally here! The big moment you have been waiting for—closing on your new home! You sign on the dotted line (many times), pay the closing costs, and get the keys to your new home! Congratulations!